By Frank Legan

Most people only think about taxes when it’s time to file their annual returns. But for people whose income varies, such as business owners, artists, or entrepreneurs, putting off this important task until April is not always the wisest decision. When your income varies, there are many things to keep track of, which is why setting aside regular time throughout the year to work on your taxes can make a big difference when it’s time to file your return.

To make the most of your irregular income, proactive tax management is a necessary part of the process. Here are 5 steps you can take to manage and reduce taxes when your monthly income varies.

1. Understand When Estimated Tax Payments Are Due

If you are self-employed or own your own business, you are responsible for paying taxes directly to the IRS in the form of quarterly estimated payments. Being your own boss means you have to calculate and remit payment for what you owe; it’s not automatically deducted from your paycheck like it is for W-2 employees.

This is great in that you don’t have to pay taxes right away, but it can quickly become an administrative and financial burden if you don’t stay on top of it.

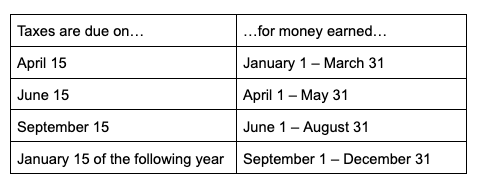

To better manage your tax payments, you must first understand when they are due. This table highlights the typical due dates for quarterly estimated tax payments: (1)

Failure to pay your estimated taxes or late payment may result in hefty penalties and fees charged by the IRS, so it’s critical to stay on top of these dates.

2. Understand How Much You Should Pay

Understanding how much you should pay in taxes can be especially difficult if your income fluctuates each year. If you overpay, you run the risk of giving the IRS an interest-free loan, and if you underpay, you run the risk of being penalized. In this case, the safest thing to do is to avoid the underpayment penalty by paying the lesser of: (2)

- 90% of your current year tax liability or

- 100% of your prior year tax liability (if your adjusted gross income for the prior year was more than $150,000, then you must pay 110% of your prior tax liability)

Keep in mind that the IRS also provides a stipulation if you receive uneven income throughout the year. You may be able to reduce or avoid penalties by annualizing your income and making unequal payments throughout the year. (3)

3. Create a Tax Plan

After you determine how much tax you should pay, the next step is to create a tax plan to ensure you save the appropriate amount. The general rule of thumb for self-employed individuals is to set aside 25-30% of their income for taxes, (4) but the exact amount you need to set aside depends on your business structure, tax bracket, state of residency, and more.

For individuals with irregular income, it’s important to adjust your savings as your income fluctuates. If you have a particularly successful month, consider putting 50-60% away to make up for months where your income is lower. Working with a wealth manager or utilizing a bookkeeping system are great ways to stay on top of your tax payments so you don’t find yourself facing a penalty come tax season.

4. Keep Track of Deductions

It’s easy to forget about all the expenses you paid for when you’re focused on managing your irregular income. But it’s important to document as much as you can in order to take advantage of every deduction. This may help reduce your tax liability, ultimately reducing your estimated tax payments and putting less strain on your uneven cash flow.

There are dozens of expenses you can deduct as a self-employed professional or business owner. (5) Here are a few of the most common deductions:

- Startup costs

- Advertising

- Online services and subscriptions

- Travel expenses

- Continuing education

- Software, hardware, and other equipment

- Health insurance premiums and medical care expenses

- Home office and supplies

- Retirement contributions

5. Partner With a Professional

Managing your tax payments can be confusing, but with the right professionals by your side, it doesn’t have to be. At Cedar Brook Group, we strive to help business owners, entrepreneurs, and other self-employed professionals manage their variable income so they can optimize their revenue.

Are you feeling overwhelmed or confused as you sort through important tax planning issues? Rather than going it alone, we want you to experience the comfort and clarity a financial professional can bring. Reach out to us at 440-683-9213, flegan@cedarbrookfinancial.com or schedule a complimentary introductory call online. Our office is open and we would love the opportunity to meet with you in person!

About Frank

Frank Legan is Partner, Financial Advisor, and member of the Forward Look Committee at Cedar Brook Group, one of the largest independent wealth management firms in Northeast Ohio. Frank spends his days designing and implementing personalized financial planning strategies for corporate executives, closely held business owners, artists, families, and retirees. He specializes in lifetime income strategies, investment advice, and estate planning services. He also works with businesses to develop strategic and succession planning strategies. Frank has a Bachelor of Arts in Political Science from the University of Dayton, as well as a Master of Public Administration focused on municipal management from Cleveland State University. Prior to joining Cedar Brook Group, Frank was a financial advisor in the private client group at Merrill Lynch and with NatCity/PNC Investments. Frank is active in his community, serving on various councils, boards, and committees. Frank serves as Chairman of the Board of Directors for Catholic Charities Diocese of Cleveland, and is a board member of the Catholic Community Foundation. When he’s not working, you can find Frank spending time with his wife, Laura, their daughter, Reese, and their beloved collie, Charlie. Frank and his family are volunteers at St. Francis of Assisi church in Gates Mills. To learn more about Frank, connect with him on LinkedIn.

Securities offered through Cadaret, Grant & Co., Inc., an SEC Registered Investment Advisor and member FINRA/SIPC. Advisory services offered through Cadaret, Grant & Co., Inc. and Cedar Brook Group, an SEC Registered Investment Advisor. Cadaret, Grant & Co. and Cedar Brook are separate entities. Please remember that securities cannot be purchased, sold or traded via e-mail or voice message system. Please contact our office at 440.683.9213 should you need assistance in placing a trade. This email transmission and any documents, files or previous email messages attached to it may contain information that is confidential or legally privileged. If you are not the intended recipient, you are hereby notified that you must not read this transmission and that any disclosure, copying, printing, distribution, or any action or omission of this transmission is strictly prohibited. If you have received this transmission in error, please immediately notify the sender by telephone at 440.683.9213 or return and delete the original transmission and its attachments without reading or saving in any manner.

The information provided here is for general informational purposes only and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Neither Cadaret Grant & Co, Inc. nor its registered representatives or employees, provide tax or legal services. Please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice.

____________

(1) https://www.irs.gov/faqs/estimated-tax/individuals/individuals-2

(2) https://www.hrblock.com/tax-center/irs/tax-responsibilities/avoiding-underpayment-tax-penalty/

(3) https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

(5) https://money.usnews.com/money/personal-finance/taxes/articles/self-employment-tax-deductions