By Dayna Smith

Few things spark more fear and anxiety in investors than a volatile stock market, which can lead to doubts about your financial future. However, for those with a long-term investment strategy, market downturns are a normal part of the market cycle and especially considering the recent volatile and declining stock market despite the U.S. economy’s 2.6% growth in the fourth quarter of 2022 (after 3.2% growth in the third quarter).

During stock market downturns and corrections, it’s crucial for investors to remain calm and acknowledge that these are all natural components of the investing cycle. Take these following tips to understand what a bear market is and how you can remain calm, cool, and collected during periods of volatility.

What Defines a Bear Market?

A bear market is defined as a prolonged period of declining stock prices, typically by 20% or more, and is often accompanied by investor concerns. While the frequency of bear markets varies, on average they occur every three to five years. Historically bear markets have lasted 289 days on average, while bull markets have lasted a few months to several years.

Since World War II there have been 14 bear markets with an average drop of about 30% and lasting around 1 year. But even with all this positive data, it can be challenging to weather the emotional storm of a downturn. What should you do to help ensure you make it to the other side with your portfolio intact? The first step: remain calm.

Don’t Panic

In the midst of an economic downturn, investing can feel much like a rollercoaster ride with its ups and downs. Investors often experience a sense of panic when the stock market takes a dip, leading to impulsive decisions that can negatively impact their investment portfolio. While it can temporarily hurt to see negative returns on your investments, the best option is to reign in your emotions and wait it out.

If you sell during a declining market, you are locking in your realized returns and may never recover if you wait too long to reinvest. The market has been historically resilient.

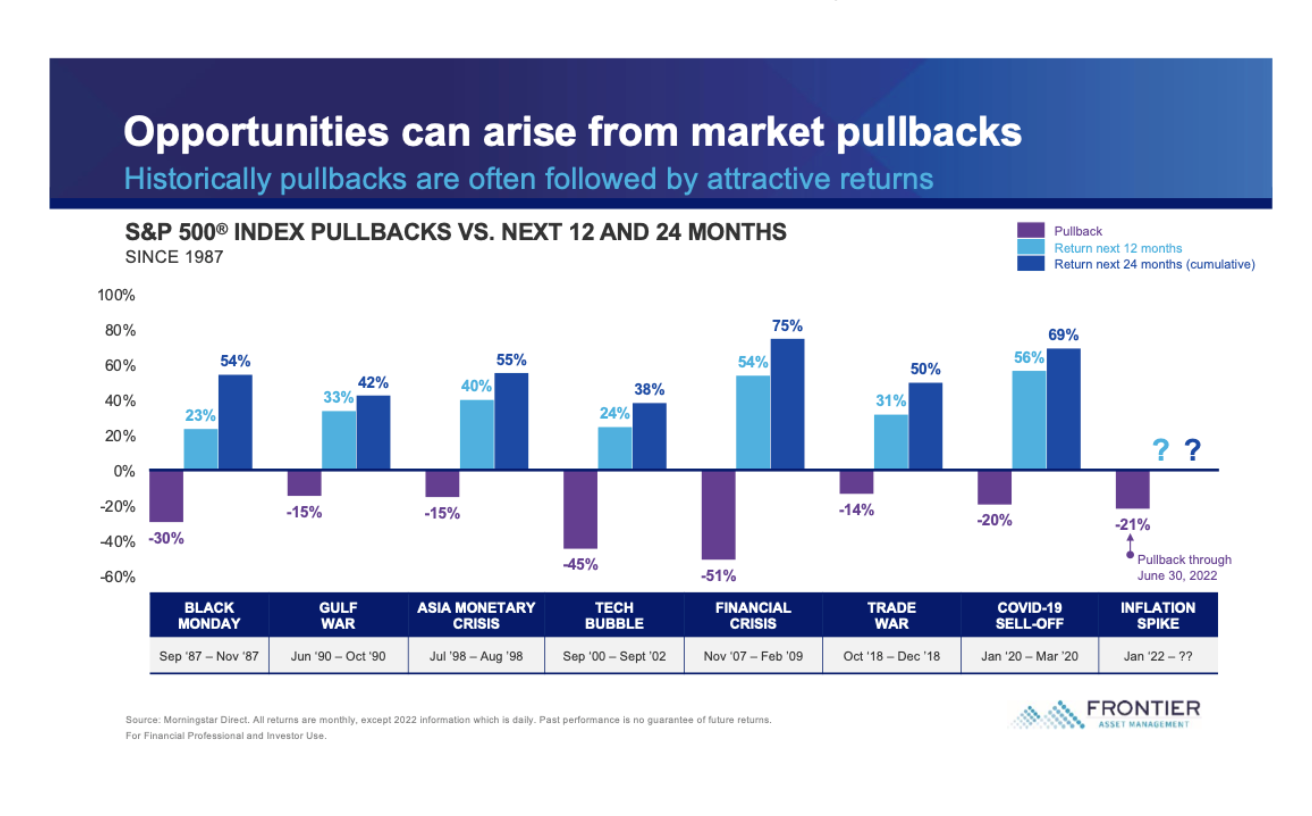

As you strive to stay the course for the long haul in your investing strategy, it’s important to realize that certain opportunities can come from market pullbacks. While there is no way of knowing where the market bottom will be, these pullbacks may present an opportunity for investors to buy stocks at lower prices. allowing them to accumulate assets for less. Additionally, pullbacks can help to reduce market bubbles and excess valuations, creating a healthier and more sustainable market environment in the long run.

Stay Disciplined

Remaining disciplined while diversifying your investments is crucial to experience long-term success, as it helps you to weather market turbulence and potentially capitalize on the opportunities that arise. You can start by reviewing your goals and assessing if any of your longer-term goals have changed in recent months and adjust them accordingly.

Also, take the time to determine your personal risk tolerance. This is perhaps the most fundamental step you can take in deciding what types of investments to make because it defines the level of loss you’re willing to accept as an investor. As you calculate your risk level, you’ll factor in variables such as your age, investment goals, and income level to find what feels most comfortable for you.

Diversify Your Portfolio

You’ve heard the adage “Don’t put all your eggs in one basket.” During a market downturn, this may be one of your greatest hedges against a loss. Not all stocks are created equal, and some will do better during down markets than others. By opting for a diversified portfolio, you can save time because diversification attempts to reduce overall portfolio risk by spreading risk amongst different uncorrelated investments.

As you consider additional ways to help minimize potential losses in your portfolio during volatile times, it’s also wise to continue adding to your portfolio whenever possible to reap the rewards of dollar-cost averaging. This is the strategy of investing a fixed dollar amount in stocks or funds at regular intervals to spread out purchases, regardless of price. By investing in smaller set amounts over time, you buy both when prices are low and high, which smooths out your average purchase price.

This strategy could involve holding onto cash longer, which may produce lower returns comparatively over longer time periods. If the market goes up during a period when you are dollar-cost averaging, you might miss out on potential gains you could have had if you invested in a lump sum.

With that said, the same risk is true if an investor withdraws money out of the market to try and reduce loss, or additional loss, and then tries to time when it might be best to get back into the market. Trying to time the market comes with its own risk and possible consequences. Be sure to understand that all investing involves risk and no strategy can assure profit nor protect against loss.

Dollar-cost averaging can be especially powerful in recessions and bear markets. Committing to this strategy means you’ll be investing at times when the market or a stock is down, and that’s when investors can potentially buy more shares for the same amount of money invested.

Talk to Your Financial Advisor

Each market pullback and recession are unique and the future is unknown, so while downturns can seem scary, taking a deep breath and realizing that they will come to an end can be key to your overall investment strategy and well-being in the long term.

At Cedar Brook Group, we go beyond the basics of money management by working to offer market insights to help you think through opportunities that can be found during down markets. We not only provide our knowledge and resources to help you weather the storm, but also act as a sounding board to any concerns you have about your finances.

When you partner with us, we do the work for you. Our goal is to build confidence in your financial future to enable you to focus on your family, work, and whatever else brings you joy. Reach out to us at 440-683-9213, flegan@cedarbrookfinancial.com, or schedule a complimentary introductory call online!